Here’s a typical story you can hear from almost any small business owner: the business opens up a credit line to a customer and decides to accept payment in 30 days. Customer buys something, promising to pay in one month. 45 days after the invoice, small business owners find themselves wondering what they can do to make their customers pay while keeping their business relationship intact. It’s a very personal and a painful process.

If you have been feeling that your customers keep stretching the payments they owe you, you are not alone. Most businesses find it extremely difficult to get paid by their customers. In fact, according to a survey by Aite Group, Visa and CashEdge, over 50% of small businesses find collecting payments to be the most challenging aspect of their cash management activities. The issue becomes even more pronounced in industries with heavy use of trade credit, where net terms such as 30, 45, or 60 days are common during B-to-B transactions. Delinquent receivables not only impact the amount of working capital businesses have to function properly, but jeopardize the profitability of many enterprises operating with low margins.

Late payments, unreachable customers, delinquent accounts might be very common in your books. The issue, however, can have drastic consequences if you do not properly deal with it to bring down your delinquencies to a manageable level. Here are a number of tips for businesses on how they can collect more payments without damaging their business relationships:

KNOW THY CUSTOMERS

Knowing your customer is critical. Especially if they are having financial difficulties. If you can find out about your customers’ financial condition, payment habits or legal issues, it will make it easier for you to come up with the proper credit limit you would want to extend to that customer, or approach your transactions with an added level of caution. Today, you can purchase credit reports from major credit bureaus to see the payment habits, legal filings and overall credit ratings of your customers. The reports are expensive however, so pick wisely.

It is usually good practice to purchase credit reports on your important customers on a regular basis to see if there are any updates on their credit, i.e. if they have any bankruptcy history, or any judgments or liens filed against them. This will give you a more complete picture of how risky your customer is. By knowing as much as you can about a customer, you should try to reduce the unpleasant surprises to a manageable minimum.

KEEP TRACK OF YOUR INVOICES

Keeping track of the invoices is VERY IMPORTANT for sound accounts receivable management. If you keep track of all the invoices with upcoming due dates, this makes it easier to get in touch with the customers who are supposed to pay you soon. Once you know the invoices with approaching due dates, you can start sending your customers very friendly reminder letters to remind them that they owe you money. As long as the language on the letters is friendly, this will keep your relationship intact, and even improve your customer service image with your clients.

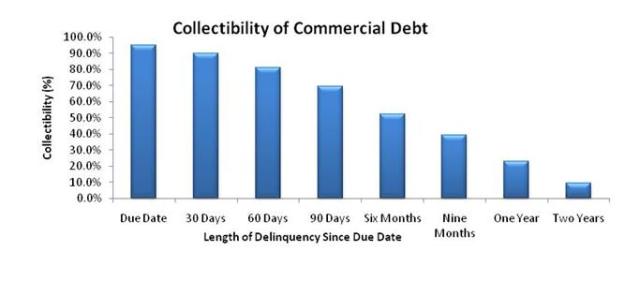

Another reason why you should keep track of invoices is that the longer you wait to contact your customer for a delinquent invoice, the less likely it becomes for your customer to pay you back (see chart below). For example, if you wait 90 days before acting on a delinquent invoice, recovery rate goes down by 20%. It is a pure numbers game. It might sounds a little aggressive, but you gotta get that reminder out to your customer as soon as possible.

PREPARE FOR THE WORST CASE SCENARIO (HOPE YOU NEVER NEED IT)

If an account is still delinquent after several collection efforts, you might need professional help. This might come in the form of an online platform or a professional collection agency that actively tries to collect your delinquent invoices. When selecting a collection agency, make sure you pay attention to these two things:

1) Recovery rate of the agency: This is the average success rate of an agency when recovering a delinquent payment. The higher it is, obviously, the better it will be for you.

2) Commission fee: This is how much the agency charges. Collection fees usually range between 30-50% for commercial accounts, depending on a number of variables such as invoice size, geography, invoice date and client profile.

Collecting delinquent accounts used to be a lot more difficult. But a series of new innovations are coming to the market to make the accounts receivable management a lot easier for small businesses. Effective tools that help companies virtually at every step of the accounts receivables process will make it easier to extend and manage trade credit between businesses.

Pingback: Collection Agencies: Why are the so sketchy?Funding Gates

Pingback: Collection Agencies: Why are the so sketchy?Funding Gates